6G Market Size, Share and Trends Analysis Report – Next-Generation Wireless Technology and Forecast to 2033

The Global 6G Market represents the next frontier in wireless communication technology, succeeding the currently deploying 5G networks with unprecedented capabilities and revolutionary applications. 6G, or sixth-generation wireless technology, is envisioned to deliver data speeds up to 100 times faster than 5G, with theoretical peak rates reaching 1 terabit per second, ultra-low latency below 1 millisecond, and massive connectivity supporting up to 10 million devices per square kilometer. This transformative technology will leverage advanced concepts including terahertz (THz) frequency bands, artificial intelligence-native networks, holographic communications, quantum communication integration, and seamless integration of terrestrial and satellite networks.

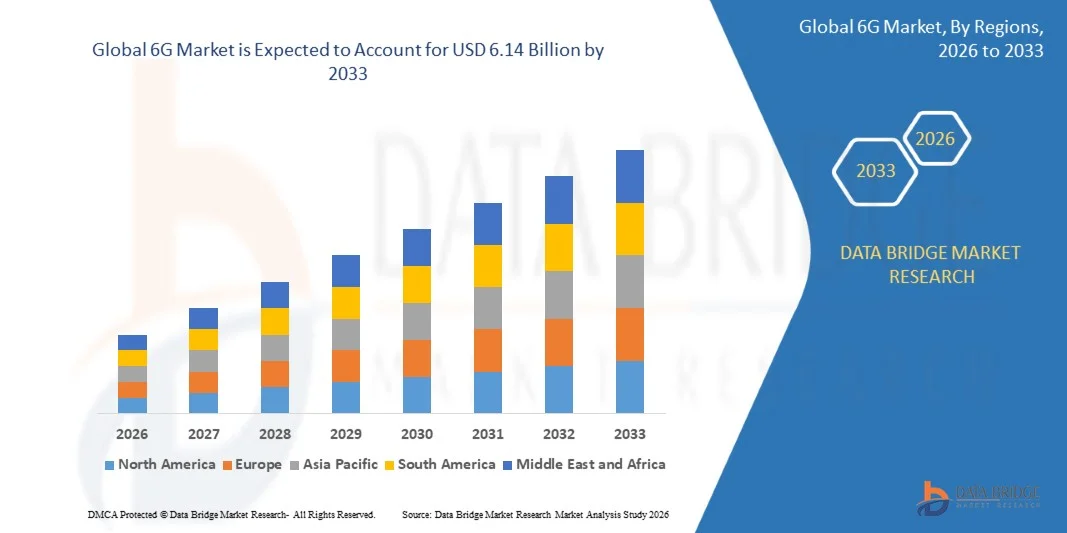

Beyond mere speed improvements, 6G aims to enable entirely new use cases impossible with current technologies, including fully immersive extended reality experiences, digital twins of entire cities, brain-computer interfaces, autonomous everything systems, and ubiquitous ambient intelligence. The global 6G market size was valued at USD 1.48 billion in 2025 and is expected to reach USD 6.14 billion by 2033, at a CAGR of 59.30% during the forecast period. This explosive growth reflects substantial research investments, early-stage technology development, spectrum allocation planning, and the telecommunications industry's drive to establish technological leadership in the next wireless generation.

Request a sample of Global 6G Market @ https://www.databridgemarketresearch.com/request-a-sample?dbmr=global-6g-market

Key Market Drivers

Several powerful factors are catalyzing the development and growth of the 6G market. The exponential increase in data traffic driven by emerging applications including metaverse platforms, holographic communications, autonomous vehicles, smart cities, and Internet of Everything (IoE) ecosystems demands network capabilities far beyond 5G's capacity. The limitations of 5G technology in supporting truly immersive extended reality, haptic internet applications requiring ultra-precise timing, and massive-scale sensor networks create clear demand for next-generation solutions.

National strategic initiatives and geopolitical competition drive substantial government funding for 6G research, with countries including China, South Korea, Japan, the United States, and European nations investing billions to secure technological leadership and establish standards. The convergence of artificial intelligence, quantum computing, and wireless communications creates unprecedented opportunities for intelligent, self-optimizing networks that can revolutionize industries. Growing demand for ubiquitous connectivity extending from ground-level to high-altitude platforms and satellite integration motivates development of comprehensive 6G architectures. Additionally, the telecommunications industry's need to plan long-term technology roadmaps, secure spectrum allocations, and develop next-generation products drives early-stage investments despite commercial deployment remaining nearly a decade away.

Market Segmentation

The global 6G market can be segmented based on component, application, end-user industry, and deployment type. By component, the market includes hardware (chipsets, antennas, network equipment, devices), software (network management, AI algorithms, security solutions), and services (consulting, integration, maintenance). Hardware components are experiencing significant research and development investments as semiconductor manufacturers work to develop terahertz-capable chips and advanced antenna systems.

Inquire here to explore industry-specific data @ https://www.databridgemarketresearch.com/inquire-before-buying?dbmr=global-6g-market

Application segmentation encompasses enhanced mobile broadband, massive machine-type communications, ultra-reliable low-latency communications, holographic communications, digital twins, extended reality, autonomous systems, and ambient IoT. Holographic communications and immersive XR applications represent particularly exciting use cases uniquely enabled by 6G capabilities. End-user industries include telecommunications, automotive, healthcare, manufacturing, entertainment and media, aerospace and defense, smart cities, and agriculture. The telecommunications sector leads early investments in infrastructure and standards development.

Deployment type distinguishes between terrestrial networks, non-terrestrial networks (satellites, drones, high-altitude platforms), and integrated terrestrial-non-terrestrial systems. The seamless integration of these layers represents a fundamental 6G innovation, enabling truly ubiquitous coverage including remote areas, oceans, and airspace. Geographic segmentation reflects regional differences in research intensity, regulatory frameworks, and commercial deployment timelines, with significant variations in 6G development strategies across leading technology nations.

Competitive Landscape

The 6G market competitive landscape features a diverse ecosystem of telecommunications equipment vendors, semiconductor manufacturers, research institutions, and technology companies positioning for future leadership. Key players include Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Nokia Corporation, Ericsson, Qualcomm Technologies, Inc., Intel Corporation, Apple Inc., NTT DOCOMO, SK Telecom, China Mobile, LG Electronics, Keysight Technologies, and Rohde & Schwarz. These organizations are investing heavily in research consortia, university partnerships, and internal development programs to advance 6G technologies.

Samsung and LG lead in publishing 6G white papers and vision documents, outlining technical requirements and potential applications. Huawei maintains substantial research efforts despite geopolitical challenges, while Nokia and Ericsson leverage their 5G infrastructure leadership to influence 6G standards development. Qualcomm and Intel focus on developing semiconductor technologies capable of supporting terahertz frequencies and AI-integrated processing. Japan's NTT DOCOMO established the world's first 6G research consortium in 2020, demonstrating proactive leadership.

Competition extends beyond traditional telecommunications players to include cloud providers like Microsoft, Google, and Amazon investigating edge computing and AI integration, as well as satellite operators like SpaceX and OneWeb exploring non-terrestrial network contributions. Academic institutions including MIT, Stanford, University of Oulu, and Tsinghua University conduct fundamental research establishing the theoretical foundations for 6G. Collaboration through international forums like ITU, 3GPP, and regional initiatives like Europe's Hexa-X project shapes technology direction and standards, though geopolitical tensions create potential for fragmented regional approaches.

Emerging Opportunities

The 6G market presents extraordinary emerging opportunities across technology and application domains. Terahertz communication systems enabling unprecedented wireless speeds create opportunities for semiconductor manufacturers, antenna designers, and RF component suppliers to develop entirely new product categories. AI-native network architectures requiring specialized hardware accelerators, machine learning algorithms, and intelligent resource management systems offer opportunities for AI technology companies and software developers.

Quantum communication integration for ultra-secure data transmission represents a frontier opportunity merging quantum technology with wireless networks. Holographic display technologies, volumetric capture systems, and computational photography solutions enabling 6G's vision of ubiquitous holographic communications create opportunities across optics, imaging, and display industries. Reconfigurable intelligent surfaces (RIS) that can dynamically control electromagnetic wave propagation offer opportunities for materials science companies and infrastructure providers.

Space-terrestrial integrated networks require innovations in satellite technology, low-earth-orbit constellations, and seamless handover mechanisms. The development of 6G-enabled digital twins for entire cities, industrial facilities, and ecosystems creates opportunities for IoT sensor manufacturers, simulation software providers, and data analytics companies. Furthermore, new spectrum management approaches, including cognitive radio and dynamic spectrum sharing technologies, present opportunities for regulatory technology solutions and spectrum optimization platforms.

Regional Analysis

Geographically, the 6G market demonstrates varied development approaches and investment levels across regions. Asia-Pacific, particularly China, South Korea, and Japan, leads in 6G research intensity and government funding. China has established 6G as a national strategic priority with substantial state support for research institutions and telecommunications companies. South Korea invested early through initiatives like Samsung's 6G research center and government-funded programs targeting 2028-2030 commercial deployment timelines. Japan's Beyond 5G initiative combines public and private sector efforts to establish technological leadership.

North America, led by the United States, pursues 6G development through public-private partnerships, including the Next G Alliance bringing together industry leaders, research institutions, and government agencies. American technology companies and universities contribute fundamental research on AI integration, terahertz technologies, and quantum communications. Canada actively participates through research institutions and telecommunications operators.

Europe demonstrates coordinated regional approaches through Horizon Europe funding programs, the Hexa-X flagship project, and national initiatives in Finland, Germany, France, and the United Kingdom. European emphasis on sustainability, privacy, and human-centric technology influences the region's 6G vision and development priorities. The European Commission views 6G as critical for digital sovereignty and economic competitiveness.

Middle East countries including the United Arab Emirates and Saudi Arabia invest in 6G research as part of broader technology diversification strategies. Other regions currently show limited 6G-specific activity but are expected to engage more actively as technology maturity increases and commercial deployment approaches.

Frequently Asked Questions (FAQs)

1. When will 6G be commercially available? Commercial 6G deployment is expected around 2030-2032, following the typical 10-year cycle between wireless generations. Current activities focus on research, standardization, and spectrum allocation, with trials likely beginning in 2027-2028.

2. How will 6G be different from 5G? 6G will deliver 100x faster speeds (up to 1 Tbps), sub-millisecond latency, AI-native architecture, terahertz frequencies, holographic communications, and seamless integration of terrestrial and satellite networks, enabling entirely new applications impossible with 5G.

3. What applications will 6G enable? Unique 6G applications include holographic telepresence, fully immersive metaverse experiences, city-scale digital twins, brain-computer interfaces, autonomous everything ecosystems, multi-sensory extended reality, and ambient intelligence with ubiquitous connectivity.

4. Which countries lead 6G development? China, South Korea, Japan, the United States, and European Union countries lead 6G research through substantial government funding, industry investments, and coordinated research programs, creating a competitive global race for technological leadership.

5. What spectrum will 6G use? 6G will utilize a wide spectrum range including sub-6 GHz bands for coverage, millimeter wave frequencies for capacity, and terahertz bands (100 GHz - 1 THz) for ultra-high-speed applications, requiring new antenna and semiconductor technologies.

Access the full Global 6G Market Report here @ https://www.databridgemarketresearch.com/checkout/buy/global-6g-market/compare-licence

For More Reports: https://www.databridgemarketresearch.com/

About Us

Data Bridge is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact

Data Bridge Market Research Private Ltd. 3665 Kingsway — Suite 300 Vancouver BC V5R 5W2 Canada

Phone: +1 614 591 3140 (US) +44 845 154 9652 (UK)

Email: Sales@databridgemarketresearch.com

Website: https://www.databridgemarketresearch.com/