Personal Gadget Insurance Market Surges with Rising Smartphone and Wearable Adoption

The Personal Gadget Insurance Market has emerged as a vital segment within the global insurance industry, driven by the rapid proliferation of personal electronic devices and growing consumer dependence on technology. Smartphones, laptops, tablets, smartwatches, and other connected gadgets have become integral to daily life for communication, work, entertainment, and financial transactions. As the value and usage of these devices increase, so does the risk of damage, theft, and malfunction. Personal gadget insurance addresses these risks by offering financial protection against unforeseen events, making it an increasingly popular choice among consumers worldwide.

This market has witnessed significant growth over the past decade and is expected to continue expanding as digital lifestyles intensify, device prices rise, and awareness about insurance coverage improves across both developed and emerging economies.

Uncover strategic insights and future opportunities in the Personal Gadget Insurance Market. Access the complete report:

https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market

Understanding Personal Gadget Insurance

Personal gadget insurance refers to insurance policies specifically designed to protect electronic devices owned by individuals. These policies typically cover risks such as accidental damage, liquid damage, screen breakage, theft, and in some cases, mechanical or electrical breakdown after the manufacturer’s warranty expires.

Coverage can vary depending on the insurer and policy type. Some plans insure a single device, while others offer multi-gadget coverage under one policy. Premiums are generally influenced by factors such as device value, type of gadget, coverage scope, deductible amounts, and geographical location.

The flexibility and customization options available in personal gadget insurance policies make them attractive to a broad consumer base, ranging from students and working professionals to businesses providing devices to employees.

Market Drivers

Rising Ownership of High-Value Devices

One of the primary drivers of the personal gadget insurance market is the increasing ownership of high-value electronic devices. Flagship smartphones, premium laptops, and advanced wearable devices come with substantial price tags, making repair or replacement costly. Insurance provides peace of mind by minimizing financial losses in the event of damage or theft.

Growing Dependence on Digital Technology

Modern lifestyles are heavily dependent on gadgets for work, education, and social interaction. Remote working trends, online education, digital payments, and cloud-based services have increased the importance of uninterrupted device usage. Any damage or loss can disrupt daily routines, encouraging consumers to opt for insurance coverage.

Increasing Risk of Theft and Accidental Damage

Urbanization and crowded public spaces have increased the risk of gadget theft, while daily use exposes devices to accidental drops, spills, and other damages. Personal gadget insurance mitigates these risks, making it a practical solution for consumers who frequently travel or commute.

Expanding Awareness and Accessibility

Insurance providers and digital platforms are actively promoting personal gadget insurance through online channels, mobile apps, and partnerships with retailers. Easy policy purchase, transparent terms, and quick claim processes have improved consumer trust and adoption rates.

Market Segmentation

By Device Type

The market is segmented into smartphones, laptops, tablets, wearable devices, and other electronic gadgets. Smartphones dominate the market due to their widespread usage, high replacement costs, and vulnerability to damage. Laptops and tablets follow closely, especially among professionals and students.

By Coverage Type

Coverage types include accidental damage, theft protection, extended warranty, and comprehensive coverage. Comprehensive plans, which bundle multiple protection features, are gaining popularity as consumers seek all-in-one solutions.

By Distribution Channel

Personal gadget insurance is distributed through insurance companies, device manufacturers, retailers, telecom operators, and digital platforms. Online channels are witnessing rapid growth due to convenience, competitive pricing, and instant policy issuance.

By End User

End users are categorized into individual consumers and commercial users. Individual consumers represent the largest share, while small and medium enterprises are increasingly insuring employee devices to safeguard business continuity.

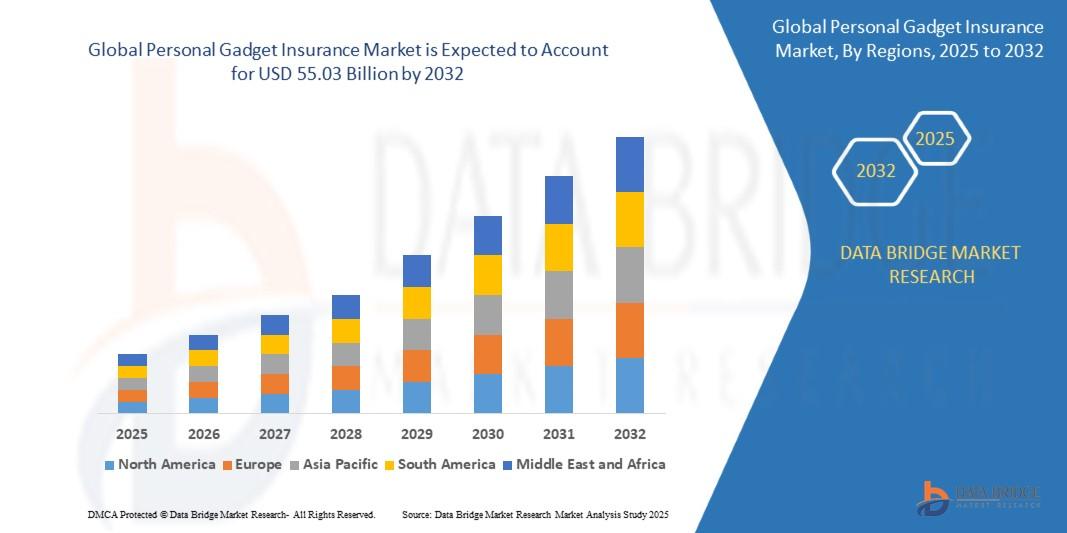

Regional Insights

North America

North America holds a significant share of the personal gadget insurance market, supported by high device penetration, strong purchasing power, and advanced insurance infrastructure. Consumers in this region are more inclined toward comprehensive coverage and extended warranty plans.

Europe

Europe shows steady growth due to increasing smartphone adoption, regulatory support for consumer protection, and rising awareness of insurance benefits. The presence of established insurers and digital insurtech startups further strengthens the market.

Asia-Pacific

The Asia-Pacific region is expected to witness the fastest growth during the forecast period. Rapid urbanization, expanding middle-class populations, rising disposable incomes, and increasing smartphone penetration are key growth factors. Emerging economies in this region offer significant untapped potential for insurers.

Rest of the World

Regions such as Latin America, the Middle East, and Africa are gradually adopting personal gadget insurance. Growth in these regions is supported by improving digital connectivity and increasing availability of affordable insurance plans.

Competitive Landscape

The personal gadget insurance market is moderately competitive, with the presence of traditional insurance companies, specialized insurers, and insurtech firms. Market participants focus on product innovation, digital transformation, and customer-centric services to gain a competitive edge.

Key strategies include offering flexible coverage options, bundling insurance with device purchases, leveraging artificial intelligence for claims processing, and enhancing customer experience through mobile applications. Partnerships with electronics retailers and telecom operators are also common to expand market reach.

Technological Advancements and Innovation

Technology plays a crucial role in shaping the future of the personal gadget insurance market. Insurers are increasingly adopting data analytics, artificial intelligence, and machine learning to assess risk, personalize premiums, and detect fraudulent claims. Digital claim submission, real-time tracking, and quick settlements have significantly improved customer satisfaction.

Usage-based insurance models and subscription-based plans are also gaining traction, allowing consumers to pay premiums aligned with device usage patterns and value depreciation over time.

Challenges and Restraints

Despite strong growth prospects, the market faces certain challenges. Limited awareness in developing regions, concerns about claim rejections, and perceived complexity of policy terms can hinder adoption. Additionally, fraudulent claims and high repair costs can impact insurer profitability.

To overcome these challenges, insurers are focusing on transparent communication, simplified policy documentation, and robust fraud detection systems.

Future Outlook

The future of the personal gadget insurance market appears highly promising. As technology continues to evolve and new gadgets enter the market, the need for specialized insurance solutions will grow. Increased digital literacy, expanding e-commerce ecosystems, and the integration of insurance offerings at the point of sale will further drive market expansion.

Sustainability considerations, such as promoting device repair over replacement, may also influence insurance product design in the coming years. Overall, personal gadget insurance is expected to become a standard component of device ownership, rather than an optional add-on.

Conclusion

The Personal Gadget Insurance Market is undergoing rapid transformation, fueled by technological advancement, rising device dependency, and evolving consumer expectations. With strong growth drivers, expanding regional opportunities, and continuous innovation, the market is well-positioned for long-term expansion. As insurers refine their offerings and enhance digital capabilities, personal gadget insurance will play an increasingly important role in protecting modern digital lifestyles.

Browse More Reports:

Global Water Treatment Chemicals Market

Global Scented Candle Market

Global Ceramics Market

Europe Japanese Restaurant Market

Global Smart Fleet Management Market

Global Tuna Market

Global Tote Bags Market

Global Gemstones Market

Global Japanese Restaurant Market

Global Hypochlorous Acid Market

Global Toothbrush Market

Global Cataracts Market

Global Wire and Cable Market

Global Plant-Based Food Market

Global Tomatoes Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com