What Is Driving Consumer Interest in the Personal Gadget Insurance Market?

"Executive Summary Personal Gadget Insurance Market Size and Share Across Top Segments

CAGR Value

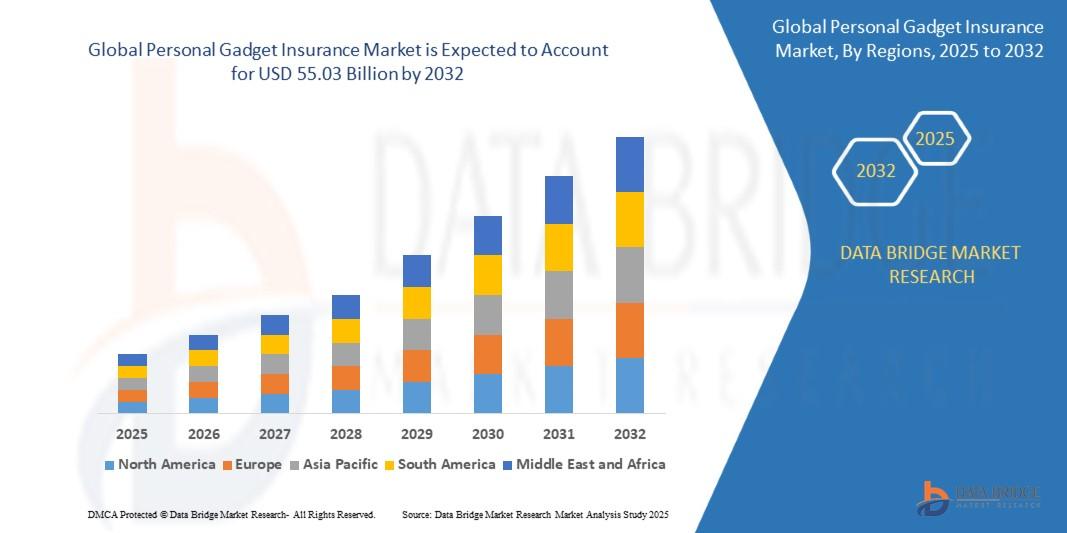

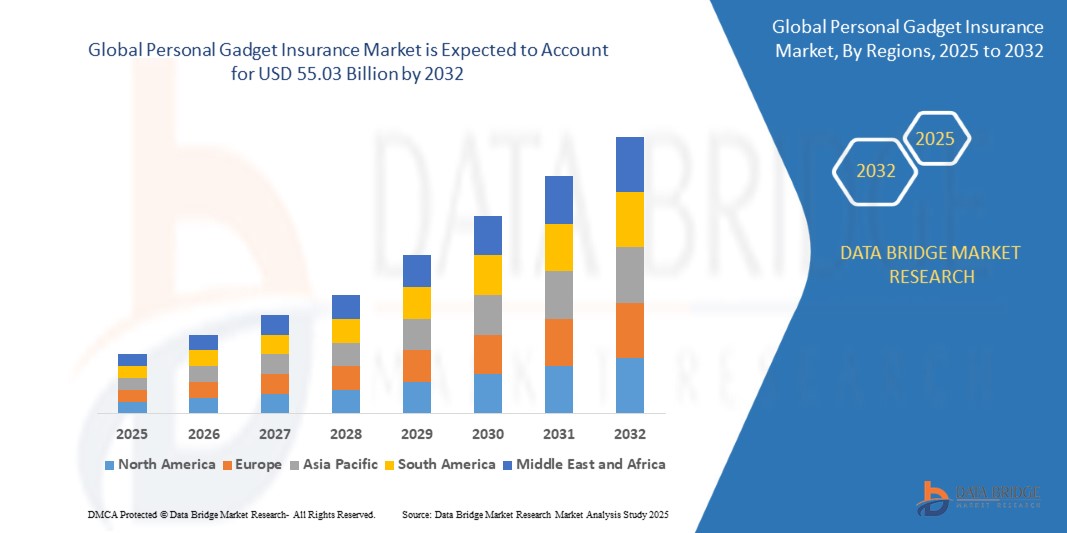

The global personal gadget insurance market size was valued at USD 25.30 billion in 2024 and is projected to reach USD 55.03 billion by 2032, with a CAGR of 10.20% during the forecast period of 2025 to 2032

To better structure this Personal Gadget Insurance report, a nice blend of advanced industry insights, practical solutions, talent solutions, and the latest technology is utilized, which gives an excellent experience to the readers or end users. The report is a valuable resource that provides current as well as upcoming technical and financial details of the Personal Gadget Insurance Market industry to 2025. CAGR values for the market for an estimated forecast period are mentioned in the report, which helps determine costing and investment values or strategies. For better understanding of the market and leading business growth, the Personal Gadget Insurance Market research report is the ideal solution.

This Personal Gadget Insurance Market report encompasses the study about the market potential for each geographical region based on the growth rate, macroeconomic parameters, consumer buying patterns, possible future trends, and market demand and supply scenarios. The use of established statistical tools and coherent models for analysis and forecasting of market data makes this Personal Gadget Insurance report shine. The study encompasses a market attractiveness analysis, wherein each segment is benchmarked based on its market size, growth rate, and general attractiveness. This Personal Gadget Insurance Market report gives explanation about the strategic profiling of key players in the market, comprehensively analyzing their core competencies, and drawing a competitive landscape for the Personal Gadget Insurance Market

Review comprehensive data and projections in our Personal Gadget Insurance Market report. Download now:

https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market

Personal Gadget Insurance Market Growth Snapshot

Segments

- Type: The personal gadget insurance market is segmented based on the type of insurance, including accident insurance, loss insurance, theft insurance, and others. Each type provides coverage for different scenarios, allowing consumers to choose a plan that fits their specific needs.

- Application: The market is further segmented based on the application, such as smartphones, laptops, tablets, cameras, and others. With the increasing use of various personal gadgets, the demand for insurance coverage to protect these devices from unforeseen events is also on the rise.

- End-User: End-user segmentation includes individual consumers and commercial users. Individual consumers opt for personal gadget insurance to safeguard their devices against damages or loss, while commercial users, such as businesses and organizations, may require coverage for multiple devices used in their operations.

Market Players

- Allianz Group: One of the leading players in the personal gadget insurance market, Allianz Group offers a range of insurance products, including coverage for personal gadgets. With a strong global presence and reputation for reliability, Allianz Group is a preferred choice for many consumers seeking insurance solutions.

- Assurant, Inc.: Assurant, Inc. is another key player in the market known for its innovative insurance offerings for personal gadgets. The company provides customizable insurance plans to cater to the diverse needs of consumers, ensuring comprehensive coverage and peace of mind.

- American International Group, Inc. (AIG): AIG is a prominent player offering personal gadget insurance with extensive coverage options and competitive pricing. With a focus on customer satisfaction and risk management, AIG has established itself as a trusted provider in the insurance industry.

- Chubb Limited: Chubb Limited is a market leader in providing personal gadget insurance with a strong emphasis on tailored solutions and responsive customer service. The company's comprehensive policies address the evolving risks associated with owning personal gadgets in today's digital age.

For more insights and detailed analysis, visit: The personal gadget insurance market continues to evolve and expand as technological advancements drive the demand for coverage against various risks and uncertainties. One key trend that is shaping the market is the increasing adoption of costly personal gadgets such as smartphones, laptops, tablets, and cameras, leading to a greater awareness of the need for insurance protection. Consumers are becoming more tech-savvy and reliant on their devices for daily activities, making it essential to safeguard against accidents, losses, theft, and other potential risks.

Moreover, the market segmentation based on the type of insurance and application allows for a more tailored approach to meet the specific needs of different consumer groups. For instance, accident insurance may be more appealing to individuals who are concerned about damages due to unforeseen events, while loss insurance could benefit those worried about misplacing their devices. Theft insurance provides a sense of security for consumers in urban areas where thefts are more prevalent. Such segmentation strategies enable insurance providers to offer comprehensive coverage options that cater to a wide range of preferences and requirements.

In terms of market players, industry leaders such as Allianz Group, Assurant, Inc., American International Group, Inc. (AIG), and Chubb Limited play a pivotal role in shaping the competitive landscape of the personal gadget insurance market. These companies offer innovative products, customized solutions, competitive pricing, and superior customer service to differentiate themselves in the market. With a focus on risk management, customer satisfaction, and continuous innovation, these players have established themselves as trusted providers that offer peace of mind to consumers and businesses alike.

As the personal gadget insurance market continues to grow, key challenges and opportunities emerge for market players to address. One of the challenges is the dynamic nature of technological advancements, leading to the need for flexible and adaptable insurance products that can keep pace with evolving gadgets and risks. Additionally, increasing competition and regulatory changes require companies to stay vigilant and proactive in their strategies to maintain market relevance and sustainability.

On the other hand, opportunities abound in leveraging data analytics, artificial intelligence, and digital technologies to enhance underwriting processes, customer engagement, and risk assessment. By harnessing the power of technology and data-driven insights, insurance providers can offer more personalized and efficient services that meet the changing preferences and expectations of today's consumers.

In conclusion, the personal gadget insurance market is witnessing significant growth and transformation driven by technological innovations, changing consumer behaviors, and the competitive strategies of market players. To succeed in this dynamic landscape, insurance providers need to be agile, customer-centric, and innovative in their approach to meeting the diverse needs of individuals and businesses seeking protection for their valuable personal gadgets.The personal gadget insurance market is experiencing robust growth and evolution as technological advancements continue to shape consumer behaviors and the need for comprehensive coverage against various risks. One significant trend influencing the market is the increasing adoption of high-value personal gadgets like smartphones, laptops, tablets, and cameras, leading to a heightened awareness of the importance of insurance protection. Consumers are relying more on these devices for daily tasks, highlighting the necessity to safeguard themselves against accidents, losses, thefts, and other potential risks.

Market segmentation based on the type of insurance and application allows insurance providers to cater to the specific needs and preferences of different consumer segments effectively. Tailoring insurance plans to address concerns such as accidents, losses, or thefts enables companies to offer a wide array of coverage options that resonate with diverse customer requirements. For instance, accident insurance may appeal more to individuals worried about unforeseen damages, while loss insurance could attract those concerned about misplacing their gadgets. Theft insurance, on the other hand, provides peace of mind to consumers in urban areas where theft risks are more prevalent.

Key industry players like Allianz Group, Assurant, Inc., American International Group, Inc. (AIG), and Chubb Limited are pivotal in shaping the competitive landscape of the personal gadget insurance market. These companies stand out by offering innovative products, customized solutions, competitive pricing, and superior customer service to differentiate themselves in a crowded market. By focusing on risk management, customer satisfaction, and continuous innovation, these market leaders have established themselves as trustworthy providers that offer consumers and businesses the confidence and peace of mind they seek.

Moving forward, the personal gadget insurance market presents both challenges and opportunities for market players to navigate. Technological advancements necessitate flexible insurance products that can adapt to the evolving gadget landscape and associated risks. Intensifying competition and regulatory dynamics also require companies to proactively adjust their strategies to maintain their competitiveness and resilience in the market.

Despite these challenges, there are significant opportunities for insurance providers to leverage data analytics, artificial intelligence, and digital technologies to refine underwriting processes, enhance customer engagement, and improve risk assessment. By embracing technology-driven insights, insurance companies can deliver more personalized and efficient services that align with the evolving preferences and expectations of today's consumers.

In conclusion, the personal gadget insurance market continues to evolve rapidly, driven by technological innovations and shifting consumer demands. Success in this dynamic environment requires insurance providers to remain agile, customer-centric, and innovative in their approach to meeting the diverse needs of individuals and businesses seeking protection for their valuable personal gadgets.

Get a closer look at the company’s market penetration

https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market/companies

Global Personal Gadget Insurance Market – Segmentation & Forecast Question Templates

- What is the market size snapshot for the Personal Gadget Insurance industry?

- What is the global market growth trend for Personal Gadget Insurance s?

- Which key segmentations are assessed in the Personal Gadget Insurance Market?

- What are the names of top-rated players in the Personal Gadget Insurance Market sector?

- What countries offer the highest opportunities in Personal Gadget Insurance Market?

- What are the names of leading regional competitors in Personal Gadget Insurance Market?

Browse More Reports:

Global Lupin Market

Global Food Extrusion Market

Global Wheelchair Cushion Market

Global Electronic Data Capture (EDC) Systems Market

Global Fruit Beer Market

Global Vane Pump Market

Global Baler Market

Global Seaweed Extracts Market

Global Sodium Silicate Market

Global Automotive Testing, Inspection and Certification (TIC) Market

Global Computer Vision Market

Global Natural Fiber-reinforced Plastics (NFRP) Market

Global Neuropathic Pain Market

Global Acrylamide Market

Global Cable Glands Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"